Medicare Supplement plans (also known as Medigap or MedSupp) help cover certain out-of-pocket costs that Original Medicare, Medicare Part A, and B, don’t cover. There are 10 plan types available in most states, and each plan is labeled with a different letter that corresponds with a certain level of basic insurance benefits.

In most states, Medigap plans have the same standardized insurance benefits for each letter category. This means that the basic insurance benefits for a Plan A, for example, is the same across every company that sells Plan A, regardless of location. This makes it easy to compare Medicare Supplement plans because the main difference between plans of the same letter category will be the premium cost.

Massachusetts, Minnesota, and Wisconsin standardize their Medicare Supplement plans differently from the rest of the country. In all states, insurance companies that sell Medicare Supplement insurance aren’t required to offer all insurance plan types. However, any insurance company that sells Medigap is required by law to offer Medigap Plan A. If an insurance company wants to offer other Medigap insurance plans, it must sell either Plan C or Plan F in addition to any other insurance plans it would like to sell.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read More: What is Medicare Plan F?

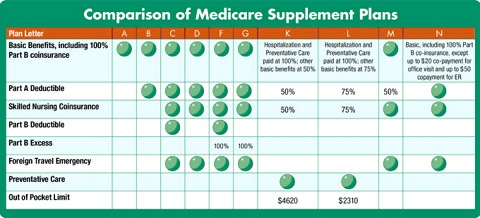

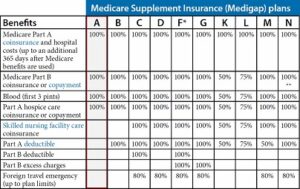

The following table allows you to compare Medicare Supplement Plans based on what is offered in standardized insurance plans that are available in most states.

2021 Medicare Supplement Insurance Plans

| Medicare Supplement insurance plan type | A | B | C* | D | F* | G | K | L | M | N |

| Medicare Part A coinsurance hospital costs up to an additional 365 days after Medicare benefits are exhausted | X | X | X | X | X | X | X | X | X | X |

| Medicare Part B copayment or coinsurance basic benefits | X | X | X | X | X | X | 50% | 75% | X | X*** |

| First 3 pints of blood | X | X | X | X | X | X | 50% | 75% | X | X |

| Part A hospice care coinsurance or copayment | X | X | X | X | X | X | 50% | 75% | X | X |

| Skilled Nursing Facility (SNF) care coinsurance | X | X | X | X | 50% | 75% | X | X | ||

| Medicare Part A deductible | X | X | X | X | X | 50% | 75% | 50% | X | |

| Medicare Part B deductible | X | X | ||||||||

| Medicare Part B ‘excess charges’ | X | X | ||||||||

| Foreign travel emergency basic benefits (up to plan limits) | 80%**** | 80%**** | 80%**** | 80%**** | 80%**** | 80%**** | ||||

| Out-of-Pocket Limit** | ||||||||||

| $6,220 in 2021 | $3,110 in 2021 | |||||||||

* There are also high-deductible versions of Insurance Plans F and G, where beneficiaries pay a deductible of $2,370 in 2021 before the Medigap insurance plan begins to cover Medicare-covered costs.

An important note about Medicare Supplement Insurance Plans F and C: You may not be able to purchase these plans if you qualified for Medicare insurance on or after January 1, 2020. That includes high-deductible Plan F. If you already have one of these insurance plans, you won’t have to give it up.

** After the out-of-pocket limit (including the Medicare Part B deductible) is reached for Insurance Plans K or L, the Medigap insurance plan pays 100% of Medicare-covered services for the remainder of the calendar year.

***Plan N pays 100% of the Medicare Insurance Part B coinsurance costs, with the exception of a copayment of up to $20 for some office visits and up to $50 for emergency room visits that don’t result in the beneficiary being admitted as an inpatient.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read More: What’s Medicare Supplement Insurance (Medigap)?

****Medically Necessary Emergency Care in a Foreign Country: coverage to the extent not covered by Medicare Insurance for 80 percent of the billed charges for Medicare-eligible expenses for medically necessary emergency hospital, medical care and physician received in a foreign country, which care would have been included by Medicare if provided in the United States and which care start during the first 60 consecutive days of each trip outside the US, subject to a calendar year deductible of $250, and a lifetime maximum benefit of $50,000. For the purposes of this benefit, “emergency care” shall mean the care that is required immediately because of an injury or an illness of sudden and unexpected onset.

Descriptions of products and services provided on these Abbys consulting websites are not intended to constitute sales or requests related to products or services. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

Read More: What’s Medigap